Introducing Egofy: verification that is quick and defensible

Turn customer onboarding into a seamless, secure experience that scales with your business. Egofy unifies identity verification and risk screening into one powerful platform, allowing you to build trust instantly while staying fully compliant.

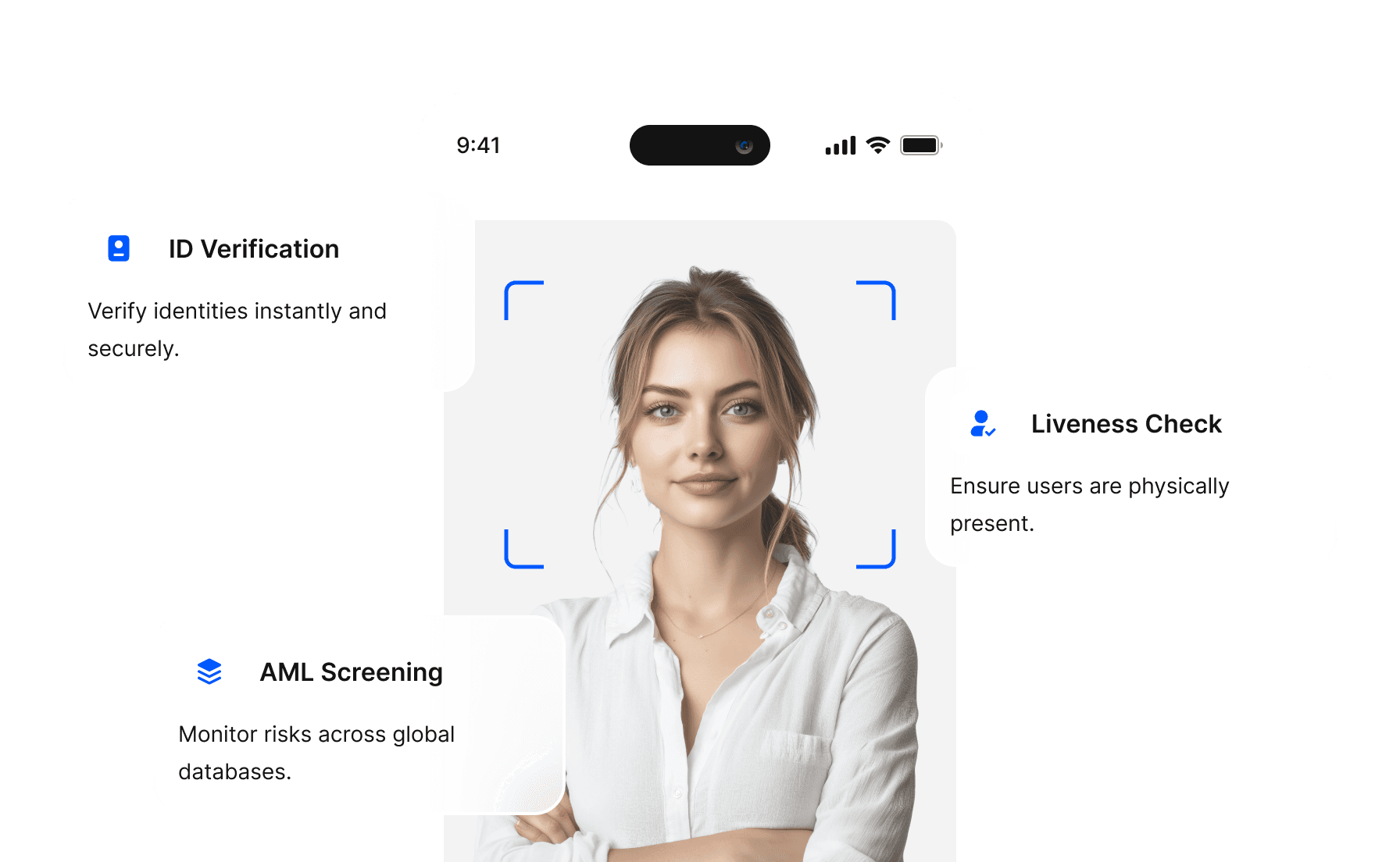

Know your customer in seconds - ID, liveness, and AML in one flow

Egofy is a secure, automated identity verification solution designed to streamline customer onboarding. It is built for compliance-driven organisations that require fast, defensible verification of customers and clear evidence for every customer-related decision. Egofy helps you meet regulatory requirements with real-time document checks, biometric validation, and AML screening, all while adhering to stringent EU and international compliance standards - reducing fraud and accelerating trust.

For organisations grappling with high alert noise, uneven pass rates, and rising audit expectations, Egofy brings the essential checks into a single, guided experience that feels smooth for users and reliable for fraud detection teams. With Egofy, verification is clear, quick, and defensible: customers complete a simple flow; your team receives a decision with evidence and the controls to meet policy and regulatory expectations. The goal is straightforward - reduce fraud, reduce friction, and make compliance easy to demonstrate while you scale.

Your all-in-one verification platform

Everything you need to onboard a customer and comply, is in one unified platform:

- ⬥

Conversion-First UX. A low-friction, customer-centric experience featuring minimal steps, guided capture, localization, and extensive global document support. Designed to maximize first-pass approval rates.

- ⬥

Real-Time Document & Biometric Validation. Automated document detection, data extraction (OCR), and a powerful face match and liveness detection to defeat spoofs.

- ⬥

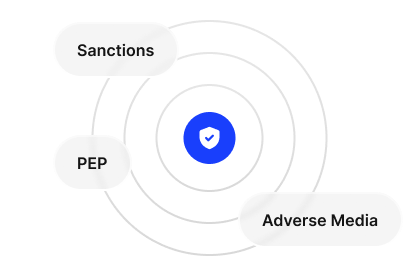

Risk & AML Intelligence. Go beyond basic ID checks with integrated, real-time screening against comprehensive, global sanctions, PEP, and adverse media lists, powered by leading, trusted data partners. Features tunable matching and entity resolution to reduce false positives.

- ⬥

Compliance & Auditability by design. Be ready for any audit. Our platform is built to support your regulatory obligations, with features like granular audit logs, role-based access controls, and configurable data retention to help you demonstrate your GDPR compliance.

- ⬥

Developer-Simple Integration. Get to market faster with clean APIs, light SDKs, and predictable webhooks. We provide clear documentation to make integration simple.

Trust at scale - without trade-offs

Designed to grow your business, not your compliance backlog.

- ⬥

Streamline onboarding to seconds. Stop forcing users through multiple, separate tools. Egofy consolidates ID, liveness, and AML into one flow, dramatically cutting your median time-to-verify.

- ⬥

Cut alert noise and reduce manual reviews. Stop wasting time on "alert fatigue". Our tunable screening and entity resolution deliver fewer false positives, freeing your compliance teams to focus on real risk.

- ⬥

Improve your first-pass approval rate. Don't lose legitimate customers to friction. Our conversion-first UX and guided capture ensure a higher first-pass approval rate, reducing drop-offs.

- ⬥

Prove your compliance, on demand. Answer auditors in minutes, not weeks. With granular audit logs and clear retention controls for every decision, you are "audit-ready by design".

- ⬥

Automate verification, focus on growth. Streamline your onboarding in minutes. Egofy automates the full verification and screening process, so you can focus on growing your business, not on compliance audits.

Pick a Plan

Simple pricing with no hidden fees. An annual subscription discount applies. A one-time integration fee applies during initial integration.

$99 per month min.

Buy NowStarter KYC in one flow-fast to launch, easy to run.

- Automated identity decision (ID + selfie + liveness)

- Key data captured from the ID (name, DOB, number, expiry)

- Liveness check to confirm a real person

- Guided capture & camera assistant to reduce retakes

- Multi-language interface and basic branding

- Hosted verification page for no-code setup (lightweight embed optional)

- Session report export (PDF/CSV) + simple dashboard overview

- Help center & email support.

$199 per month min.

Buy NowAdds fraud controls and human review when needed.

- Human review on edge cases (only when required)

- Watchlist & PEP screening with monitoring (covers global official lists for standard compliance)

- Smarter alert controls to reduce false positives

- Proof of Address: upload bills/statements with automatic reading

- API & webhooks to pull results into your system

- Use the hosted page or embed in your app; basic branding included

- Exports & reports (PDF/CSV/JSON)

- Priority support

Volume pricing discounts

Talk to SalesHighest assurance and control tailored to your volume, data rules, and regulators.

- Enhanced AML screening with top global data providers.

- Configurable flows and decision rules.

- Advanced analytics and audit dashboards.

- Unlimited number of workflows.

- Security & privacy reviews.

- Granular data retention and automated deletion controls.

- Single sign-on and custom roles/permissions.

- Dedicated account manager and custom SLAs.

Testimonials

Become a partner today

Maximise efficiency, growth, and innovation with the Nebi software ecosystem. Powered by data-driven automation and intelligent optimisation, our solutions transform organisations for the future.

Explore ProductsOur manual review queue was unmanageable. Egofy’s entity resolution cut our false positives by half overnight. We finally have time to focus on actual fraud instead of clearing false alarms.

George R.

Head of Risk, Crypto Platform

Speed is everything in our market. Switching to Egofy reduced our onboarding time from minutes to seconds, and our sign-up completion rate immediately went up.

Nicole Z.

Product Owner, Banking

The audit-ready promise is real. When regulators asked for our screening logic, we didn't scramble. We just exported the decision logs. It turned a stressful audit into a non-event.

Rachel D.

Wealth Management

We expected a month-long integration. Our devs had the SDK running in two days. It’s rare to find a compliance tool that developers actually like working with.

Sophia L.

CTO, iGaming

Managing separate vendors for ID and AML was a blind spot for us. Egofy unified everything. Now we see the full risk profile of a user in one dashboard, instantly.

Nick R.

VP of Operations, Fintech

The guided capture is brilliant. We have far fewer retries because the system actually tells users how to fix the photo. It’s a better experience for them and less support work for us.

Emma S.

Head of Customer Onboarding, Insurance

Frequently asked questions

Take a moment to review answers to common inquiries for a smooth and informed experience.

Egofy is an AI-powered identity verification platform that authenticates ID documents, proof of address, and user biometrics in real time. It combines machine learning, OCR, and liveness detection to help businesses meet KYC, AML, and fraud-prevention requirements with high accuracy.

Accepted documents depend on the user’s country and your compliance needs. Egofy commonly verifies passports, national ID cards, residence permits, and driver’s licenses. For proof of address, it supports utility bills, bank statements, tax documents, and other official records.

Most verifications are completed within a few minutes. Cases that require manual review or additional checks may take longer depending on your compliance rules.

Yes. Egofy includes advanced biometric liveness detection to confirm that the person presenting the document is physically present, helping prevent spoofing and impersonation.

Yes. Egofy can screen users against global AML watchlists, sanctions databases, and PEP lists, helping you stay compliant and detect high-risk individuals before onboarding.

Yes. Egofy offers seamless integration through simple API calls. With just one request, you can generate a secure, session-specific URL that can be embedded directly into your platform using an iframe. This allows you to deliver our full functionality inside your own interface, no complex setup, no heavy development, just plug-and-play integration.

Access to verification data is strictly limited to authorized personnel and systems involved in the verification process, with role-based permissions ensuring that only approved individuals can view or manage sensitive information. Data can be shared through secure webhooks, which notify your endpoint of status changes or key events, allowing you to retrieve full details and results via our API.

Egofy uses strict security controls, including encryption, role-based permissions, and GDPR-aligned data handling. Access is restricted only to authorized personnel and systems involved in the verification process.

Egofy includes real-time dashboards showing verification volume, approval rates, rejection reasons, risk alerts, document types, and customer distribution metrics. These insights help you optimize onboarding performance and detect friction points.

Yes. Egofy’s tunable screening and entity resolution reduce false positives, lower manual review workload, and help compliance teams focus on genuine risks.

Egofy follows industry-standard compliance frameworks, including secure data encryption, role-based access controls, and GDPR-aligned data handling practices.

Egofy is built for audit readiness. It provides granular audit logs, role-based access controls, configurable data retention, and clear evidence for every verification decision—helping you demonstrate GDPR and regulatory compliance at any time.

Egofy works with multiple document types and supports a wide range of countries. Coverage depends on your compliance needs and can be expanded as necessary.

Egofy is built for both conversion and compliance. It offers a low-friction customer flow, accurate biometric and document validation, tunable AML screening, and full auditability - making onboarding fast for users and defensible for compliance teams.